This will help you identify delinquent accounts and take necessary actions.įor example, you might want to hold off on a shipment to a customer who has a bill 90 days past due. Review your customers' accounts monthly and categorize receivables as current, 30, 60, or 90 days or more past due. If you want customers to pay early, consider giving discounts of up to two percent to clients who remit payment within 10 days.Īging accounts. Decide when you will invoice, and communicate your billing terms to customers to prevent discrepancies about when bills areĭue. Typically, the faster you bill, the faster you'll get paid. Decide whether to accept checks andĬredit cards, how you will investigate new customers before extending credit, if you will require your customers to pay deposits before delivering goods or services, and if you will charge interest on late accounts.īilling policies. Define under what conditions you will extend credit, how much credit you'll extend, and to whom. If you are running MultiLedger 7. If you are running MultiLedger 7.3 or older, call 80 to order MultiLedger 7.5 for 199.

MULTILEDGER REGISTRATION NUMBER SOFTWARE

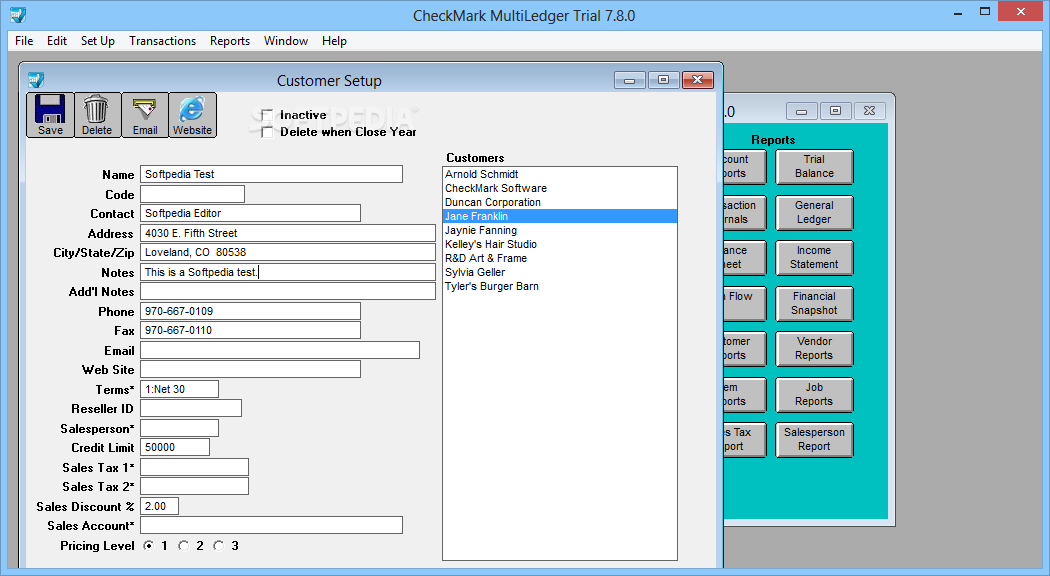

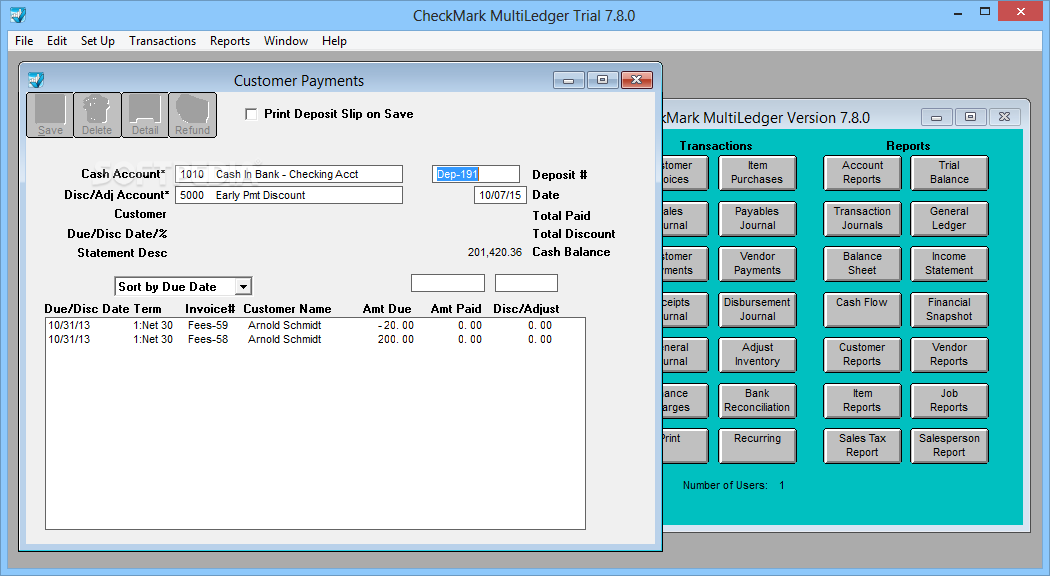

Establish a stringent credit policy and adhere to it. If you are running MultiLedger 7.4, you can order online to get MultiLedger 7.5 for 99. Your Megger account allows you to register your equipment for warranty, and access a wide range of support material including software updates and technical documents. Use programs such as QuickBooks, CheckMark MultiLedger, and MYOB Accounting to handle their accounts receivable and other accounting needs.Ĭredit policies. Many small companies, especially ones with large amounts of receivables, Software can simplify the receivables process and provide you with additional forecasting, invoicing, and tracking tools. When you set up your accounts receivable process, don't ignore these important issues:Īccounting software.

CheckMark MultiLedger Small business accounting software thats multi-user & cross-platform. Lack of working capital is the principal reason small businesses fail. CheckMark Payroll Simple payroll software that’s easy to use, accurate & secure. Without a steady cash flow, many small businesses tend to borrow more and more money to meet their working-capital needs. Tracking receivables is an essential part of managing your company's cash flow. If you wait much longer than 90 days to begin recovering unpaid receivables, your chance of collecting drops dramatically. Once a debt is 60 days to 90 days past due. Most companies call in a collection agency Base your decision on how much money is owed to you and the history of your relationship with the customer. May want to go directly to a collection agency. If that doesn't work, you may want to send a few past-due letters yourself, or you The day after an account becomes overdue, you should place a polite phone call to the customer who owes you money.

0 kommentar(er)

0 kommentar(er)